Mobile internet has become an indispensable infrastructure for production, daily life, and economic and social development. Based on the two dimensions of “the entire industry and key segmented industries,” iResearch, a subsidiary of AsiaInfo, has analyzed the development of China's mobile internet in 2023 and launched the “Top-tier APP Value Ranking.”

01

Overview of China's Mobile Internet Development in 2023

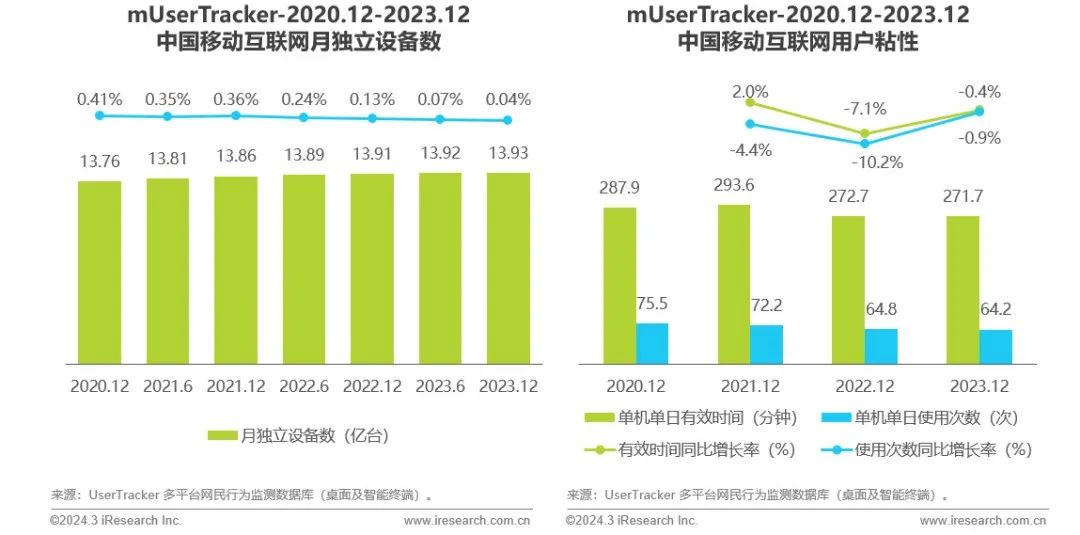

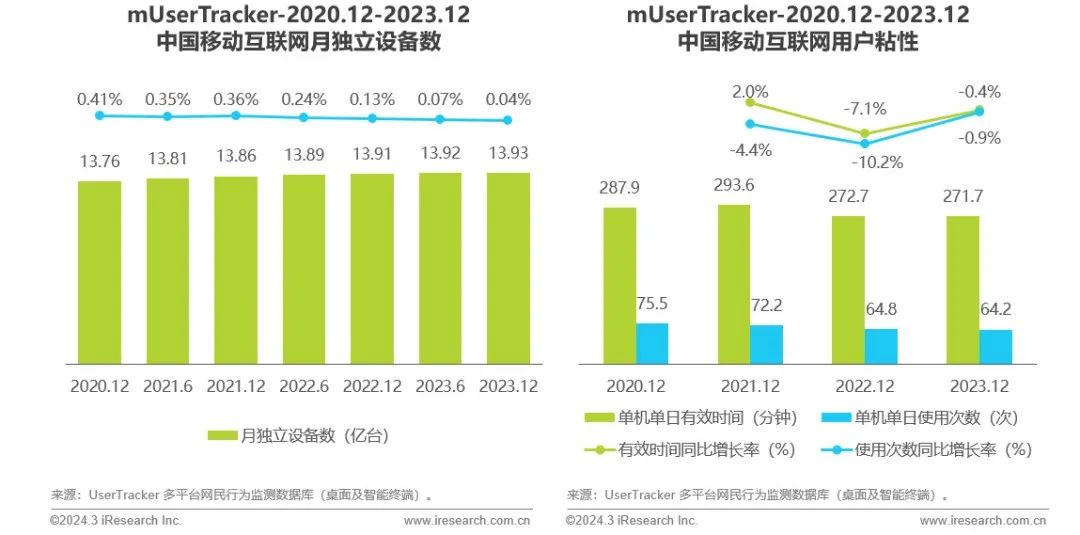

Trends in China's Mobile Internet Traffic and User Engagement

In 2023, the growth rate of mobile internet traffic in China continued to slow down, entering a period of deep stockpile. User engagement experienced a certain degree of decline but is currently stabilizing.

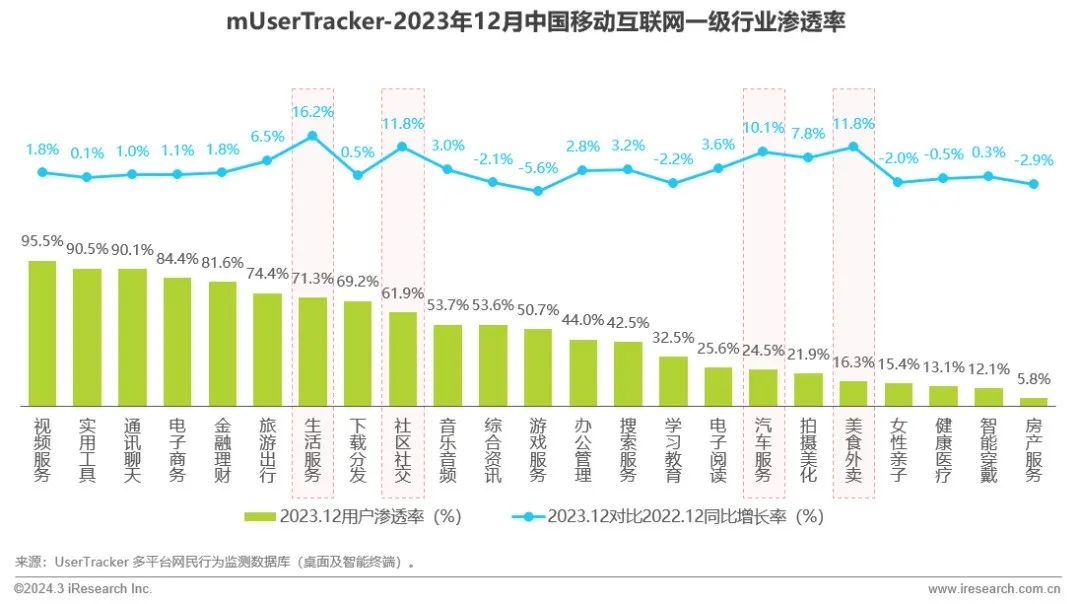

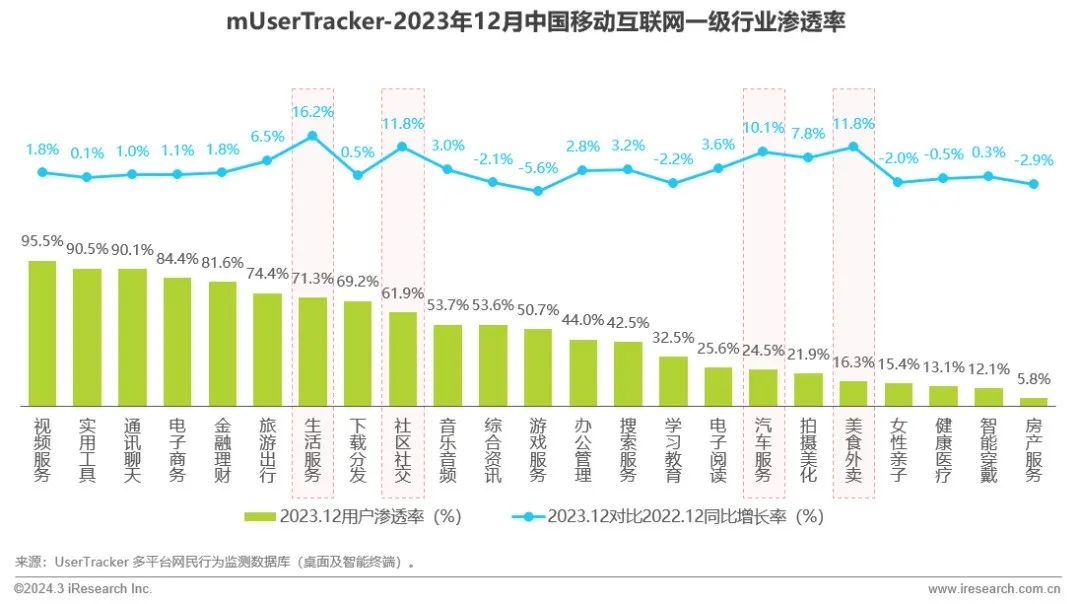

Primary Industries of China's Mobile Internet

Among the 23 primary industries, lifestyle services, community social networking, automotive services, and food delivery showed higher year-on-year traffic growth rates, with the travel, photography, and photo retouching industries also exceeding 5% growth, while other industries performed poorly.

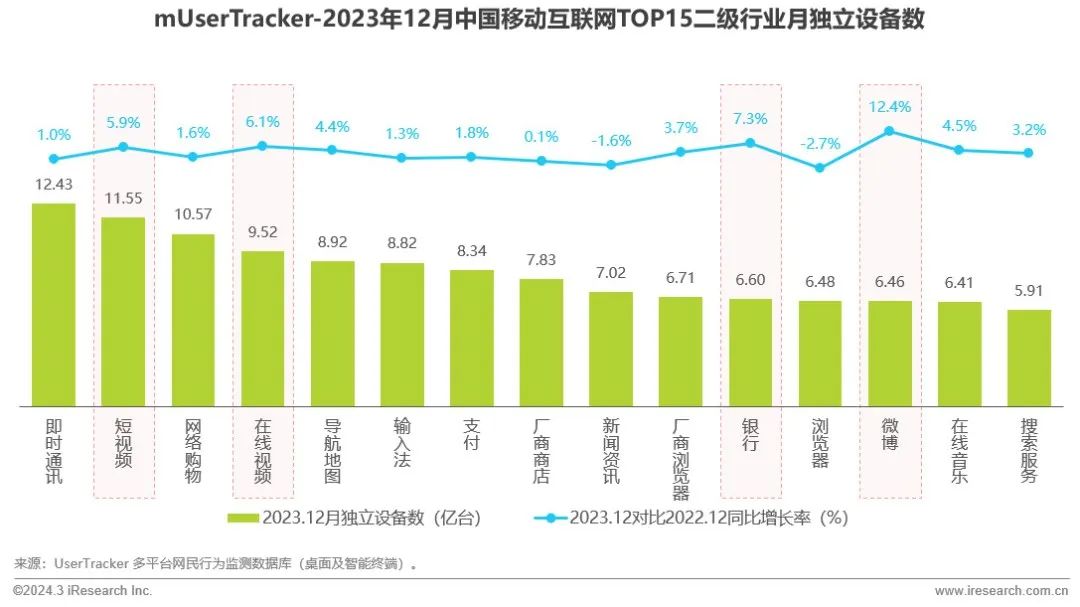

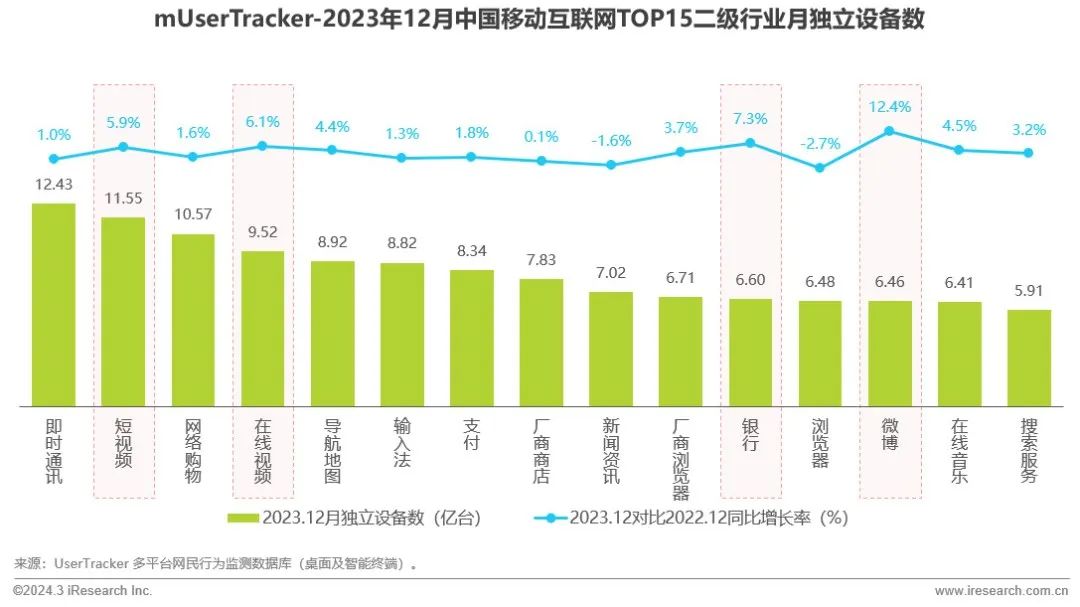

Secondary Industries of China's Mobile Internet

Among the 162 secondary industries, Weibo, banks, online video, and short video have led the growth among the Top 15 fields in terms of user scale, while news and information, as well as browser traffic, have shown negative growth.

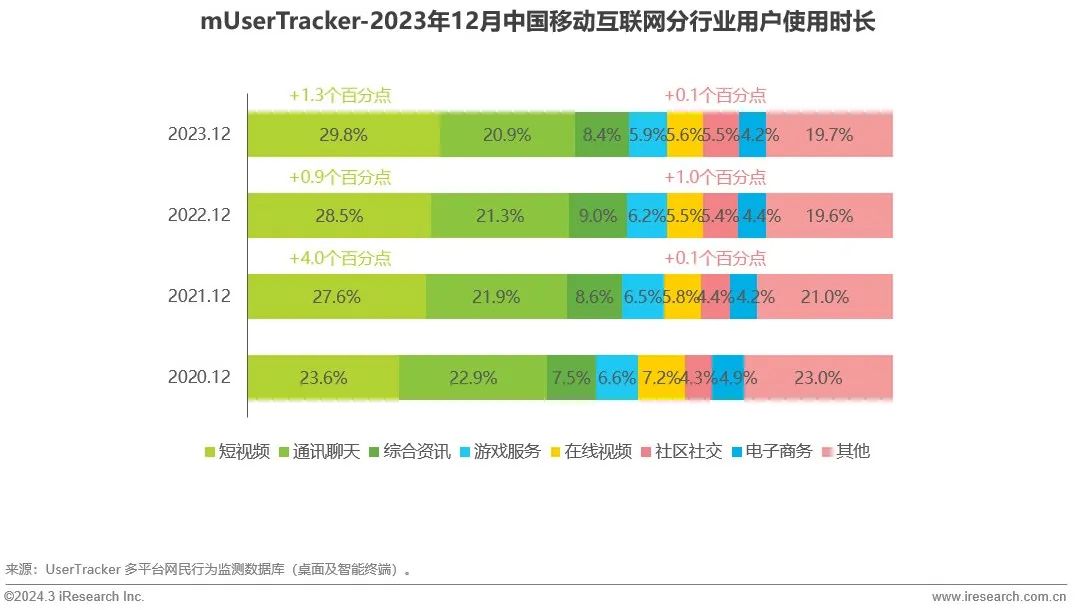

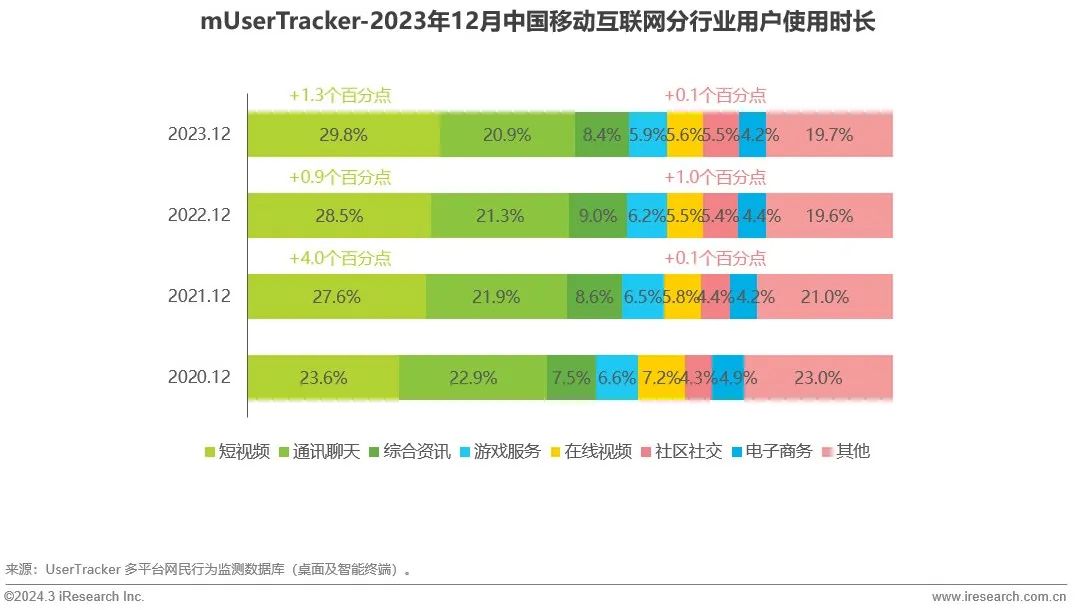

Engagement Duration of China's Mobile Internet Users

The proportion of time spent on community social networking industries has also increased slightly, while the short video industry continues to occupy the time of other industries, further attracting internet users.

Media Preferences of China's Mobile Internet Users

There are significant differences in APP usage among different genders of internet users. Female users prefer parenting and photography, as well as photo retouching Apps, while male users are more inclined to automotive service Apps.

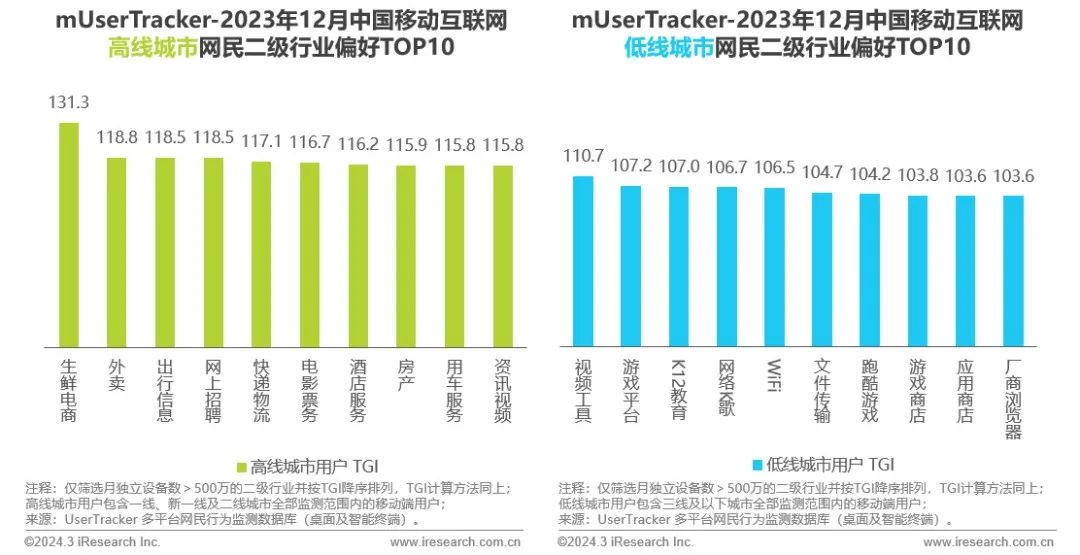

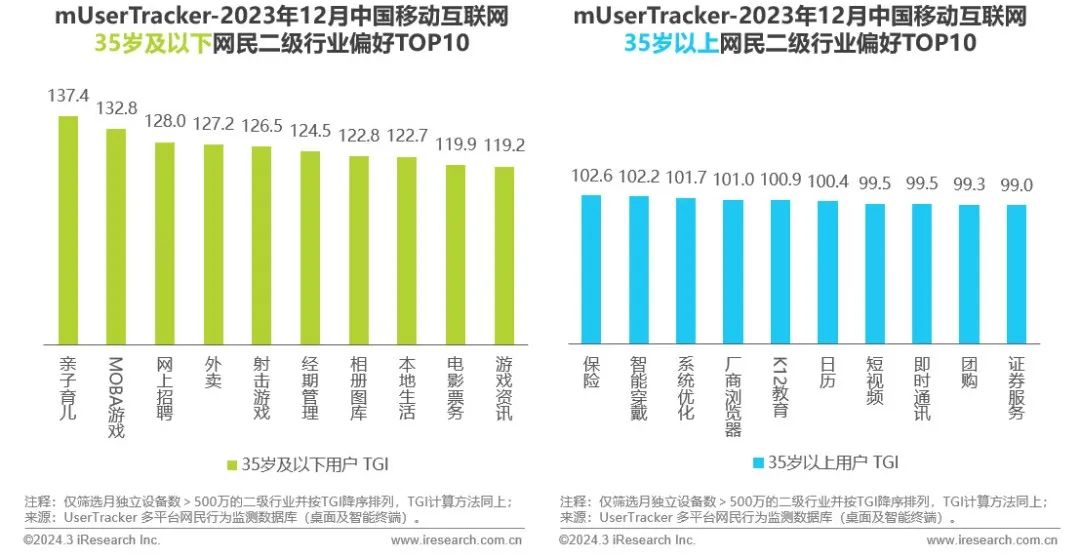

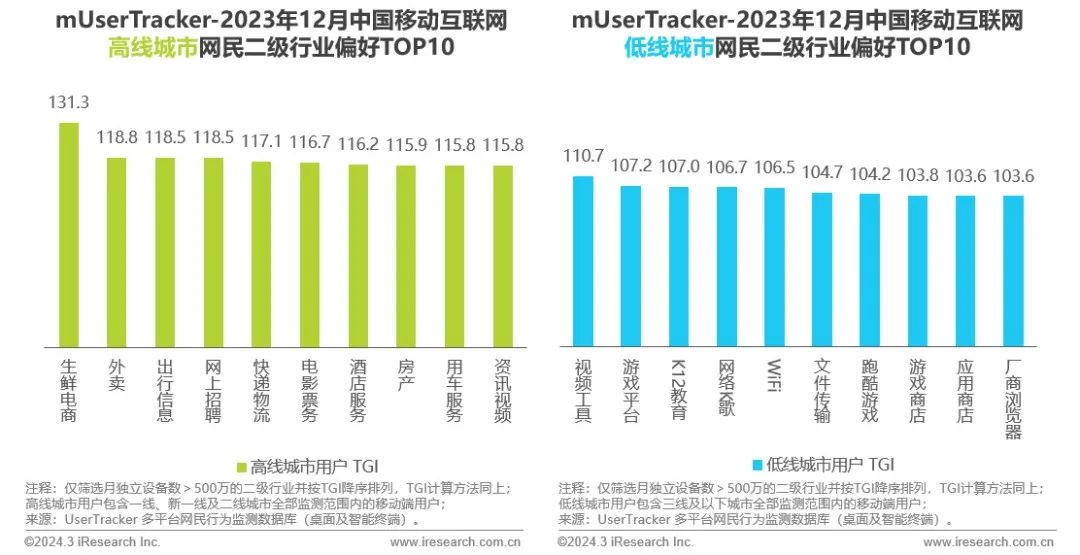

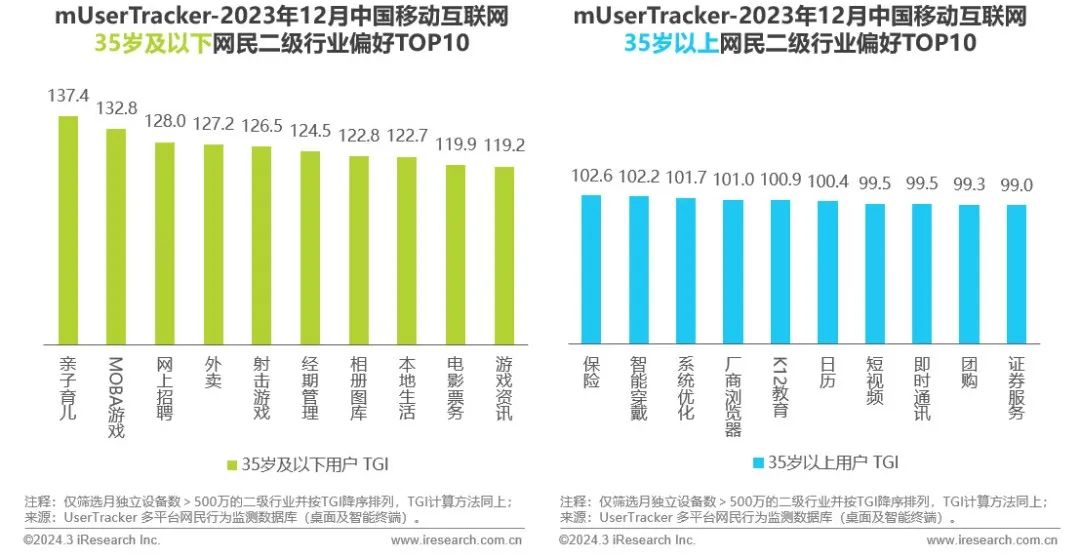

Users in high-tier cities prefer a wide range of app types covering daily life, while users in low-tier cities prefer pan-entertainment, educational, and utility Apps.

Middle-aged and young users have a clear preference for parenting, gaming, and recruitment-related Apps, while older users tend to prefer financial management, smart accessories, and utility Apps.

02

Details of Key Segmented Industries in 2023

—— Local Life ——

Comprehensive Local Life Services - Industry Trends and Overview of Mainstream Apps in 2023

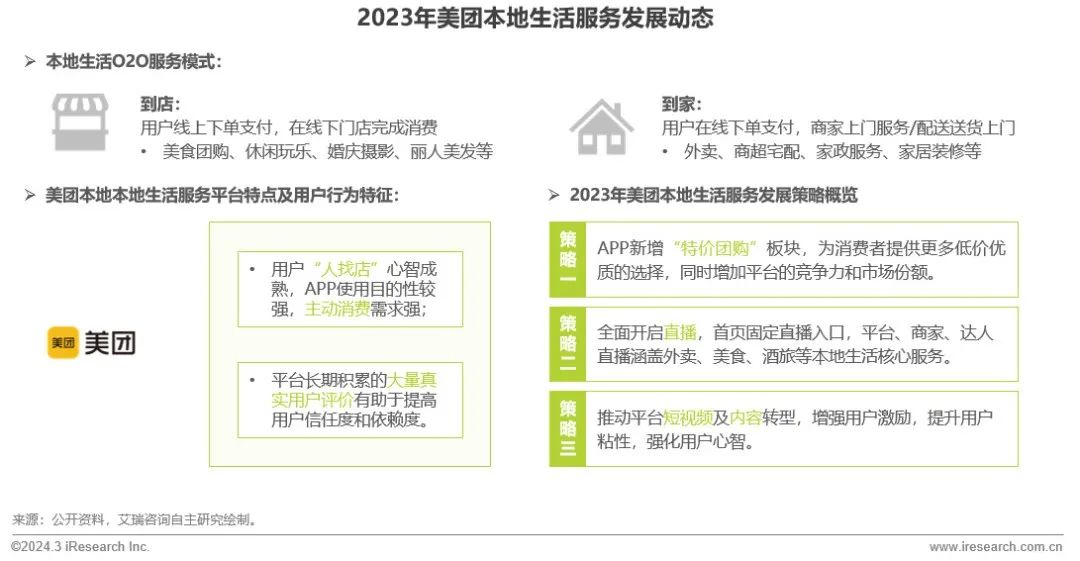

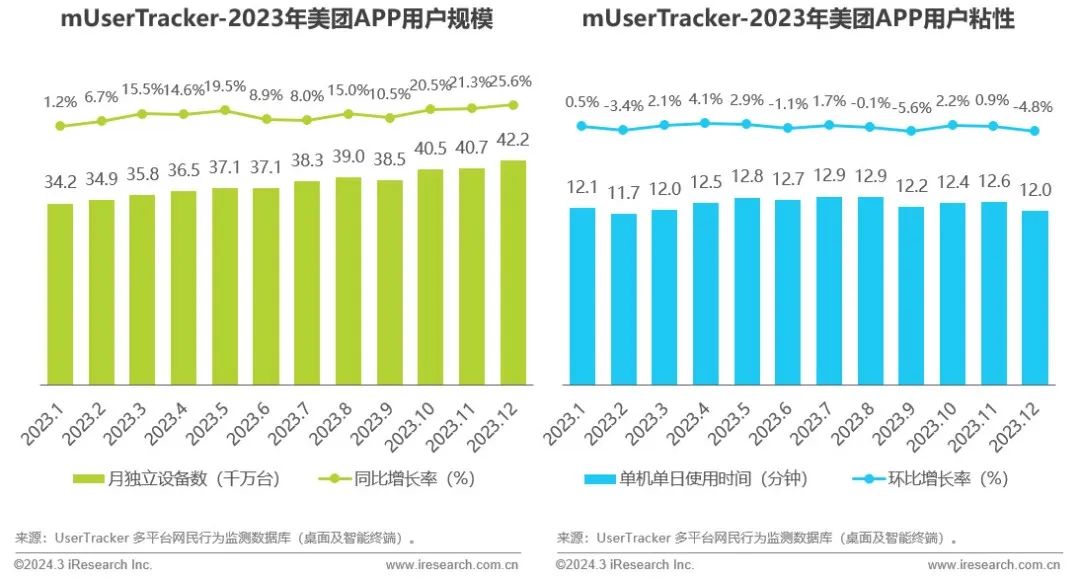

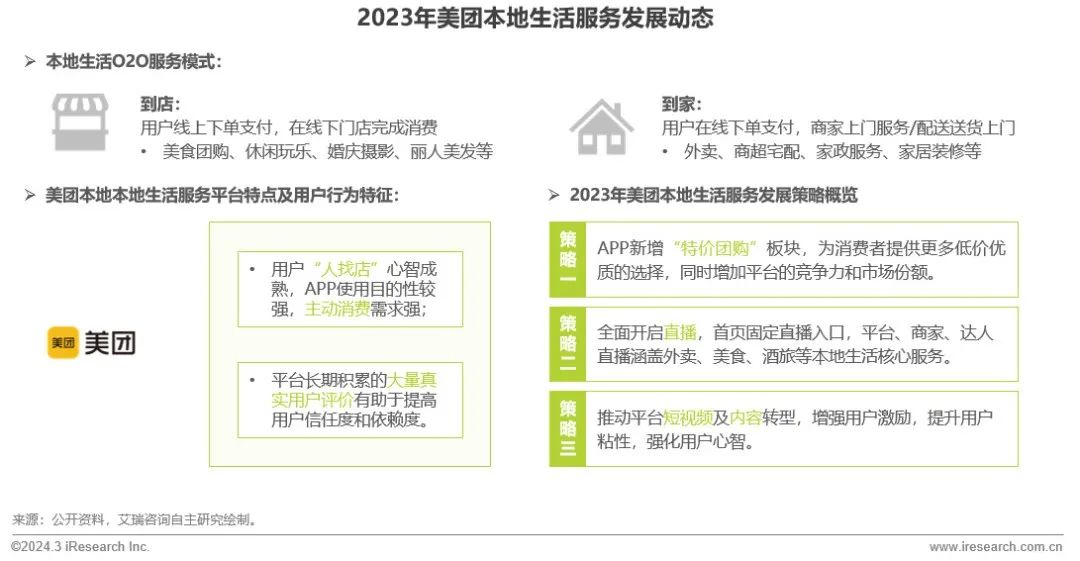

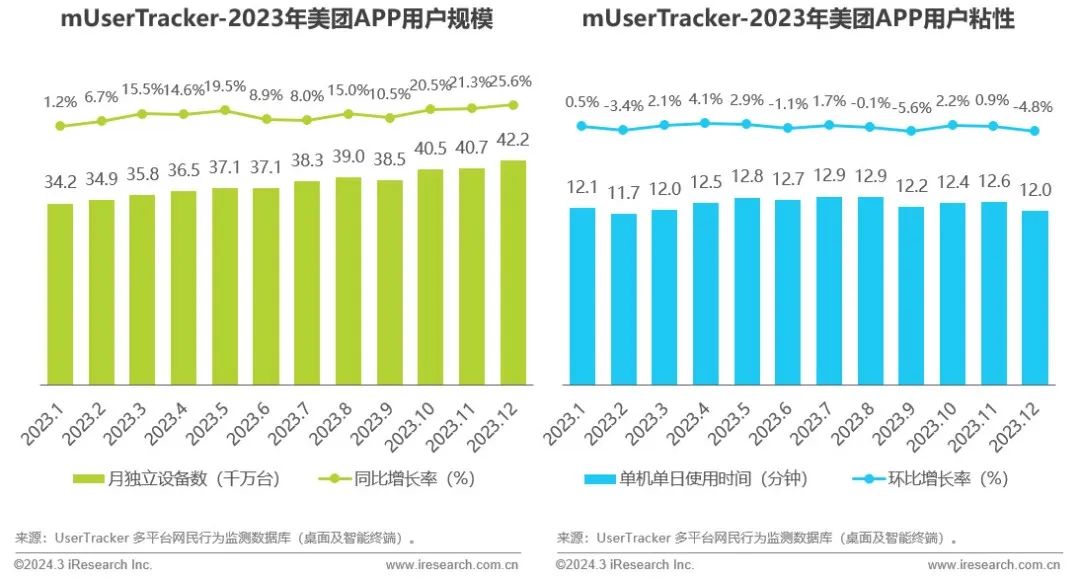

The fierce competition between the two giants has jointly propelled the diversified development of the local life market. Douyin has continued to make strong efforts in its local life business, achieving steady expansion; Meituan has responded promptly by introducing new features and improving its content ecosystem. The traffic of Meituan APP has achieved positive growth throughout the year, reaching a peak in user duration after the launch of live streaming in April.

Fresh Food E-commerce - Industry Trends in 2023

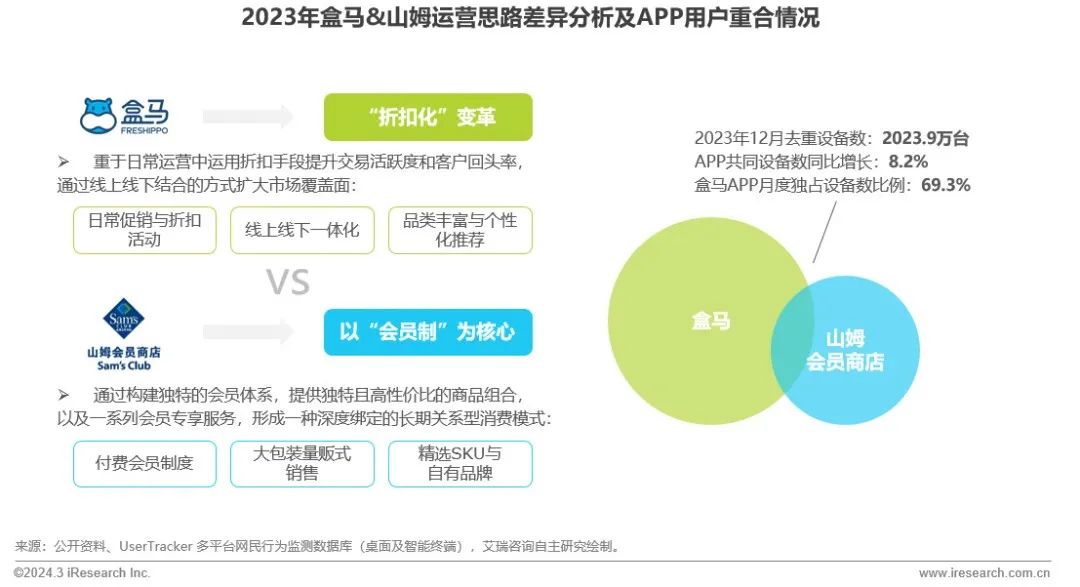

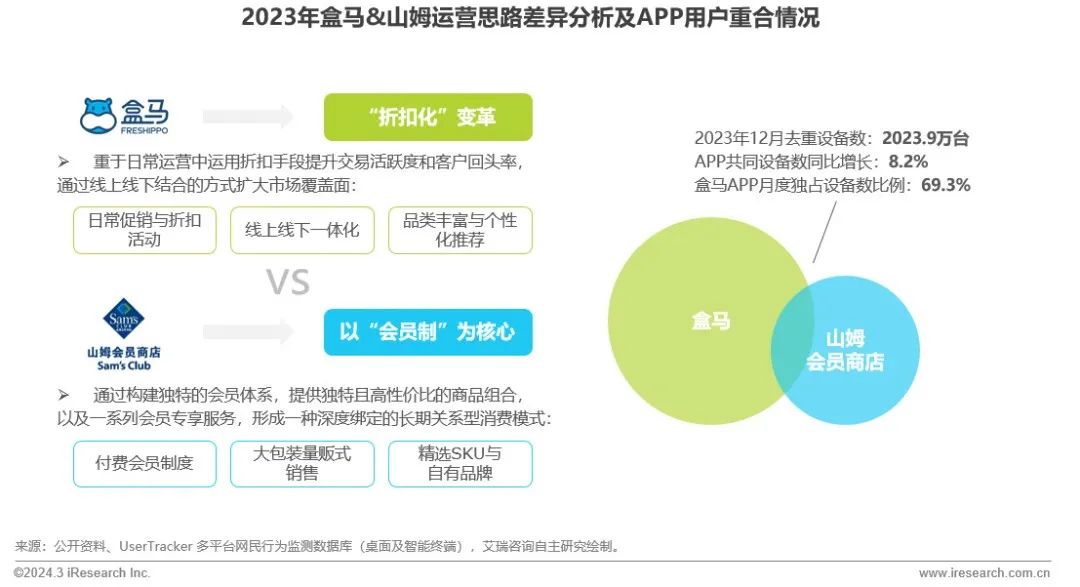

The price battle between Freshippo and Sam's Club has intensified, resulting in a growing overlap among their user bases. Nevertheless, their loyal customers maintain their distinctiveness and separation.

Car Services - Industry Trends in 2023

In mid-2023, the number of online car-hailing users in China reached 472 million. The ride-hailing sector has witnessed a remarkable surge in traffic growth, with fierce competition among major platforms like DiDi Global and Amap for attracting users.

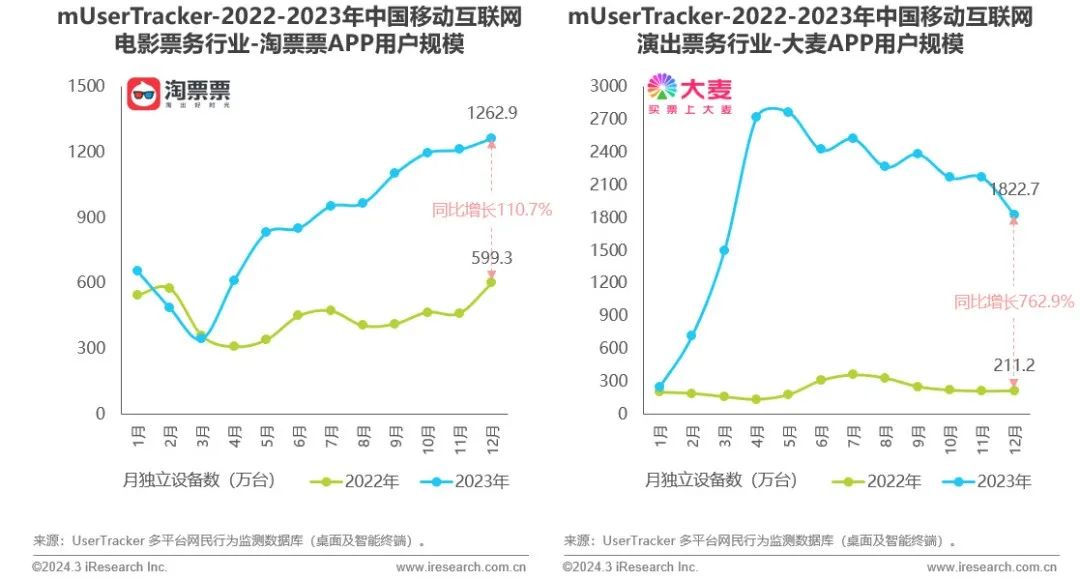

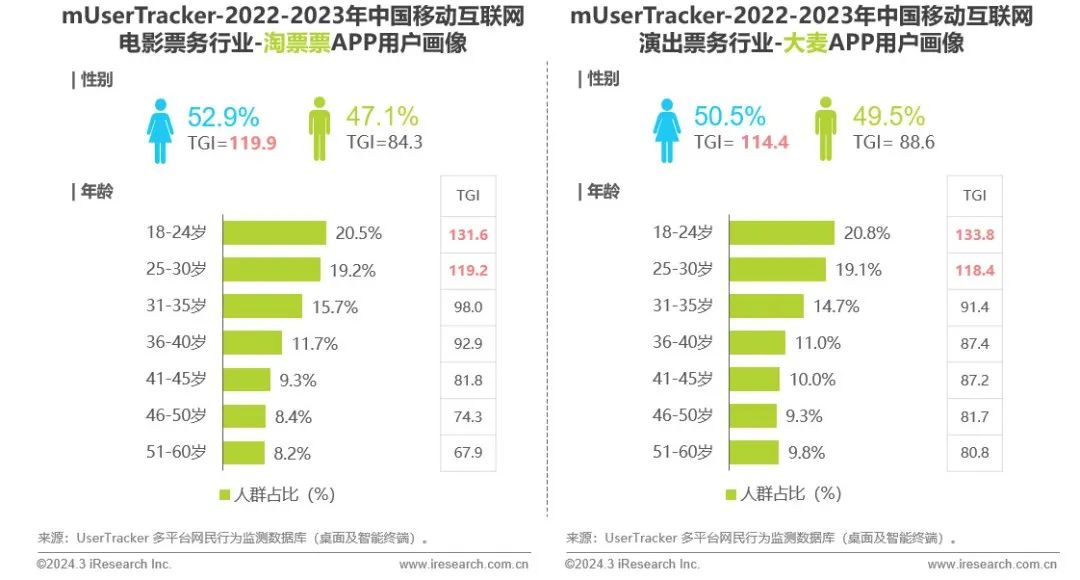

Movies and Performances - Overview of Typical Industry Apps and User Personas

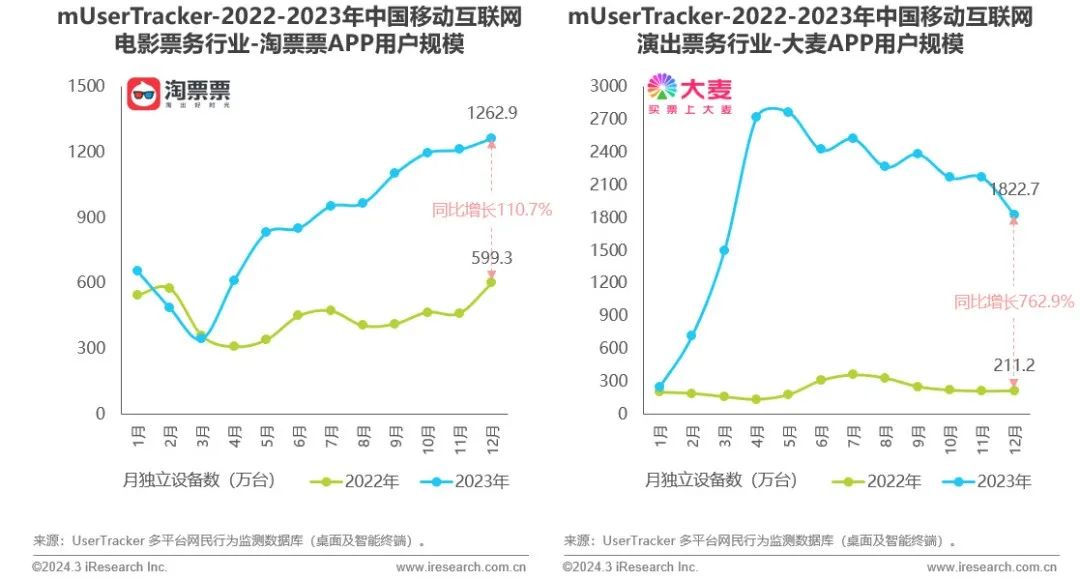

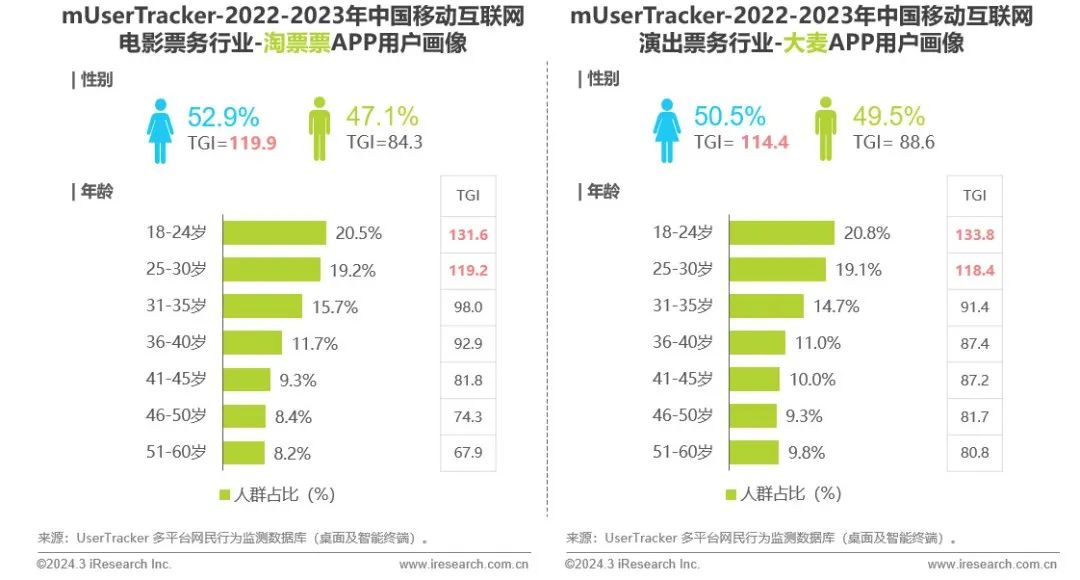

The ticketing market for movies and performances remains robust, with a marked surge in the number of active users on popular Apps like Taopiaopiao and Damai. Young female groups show significant usage preference, becoming the main source of traffic and consumption.

—— Shopping & Trips ——

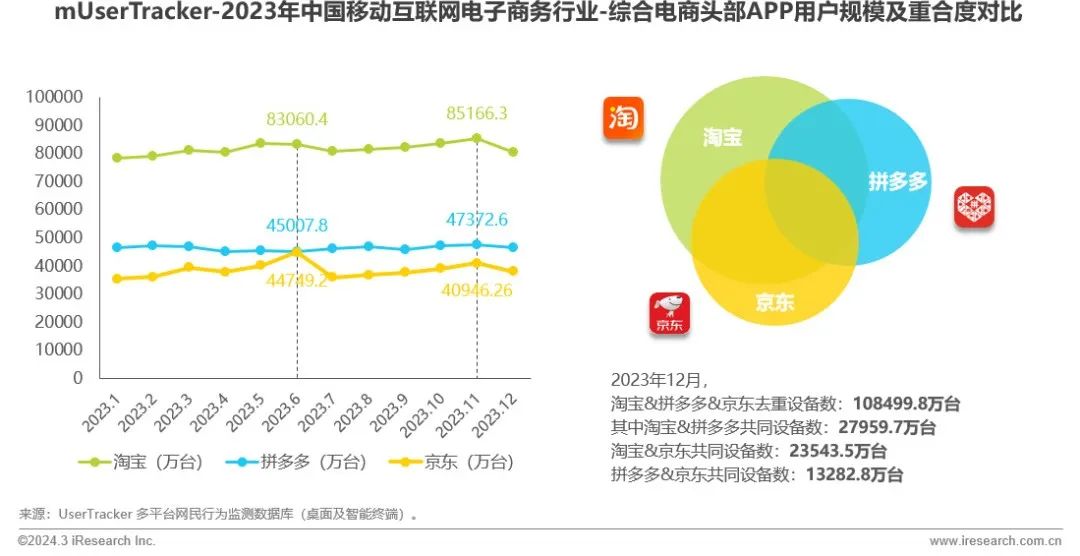

E-commerce - Industry Trends and Overview of Mainstream Apps in 2023

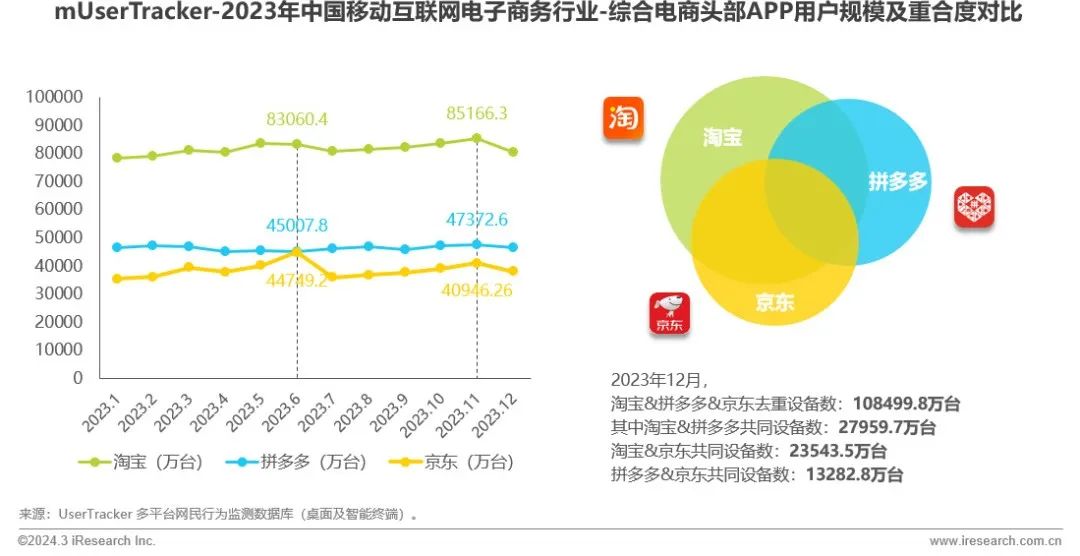

The industry landscape is undergoing changes, and competition among both new and old players is intensifying. Price has become an important means for various platforms to compete for market share. The competition for traffic among leading platforms is also intensifying, with a high overlap in user bases among the three major Apps: Taobao, JD.com, and Pinduoduo.

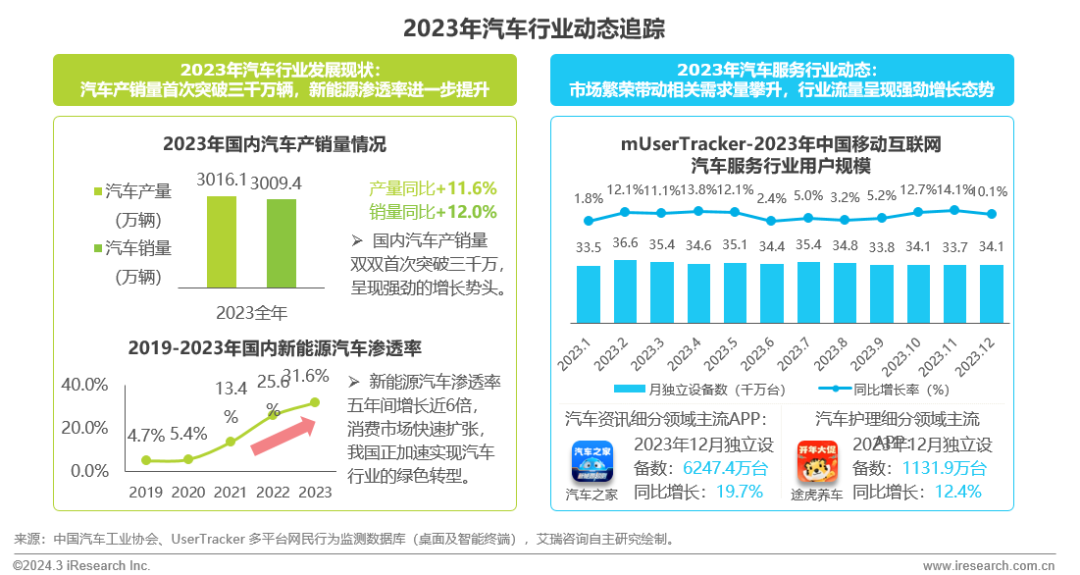

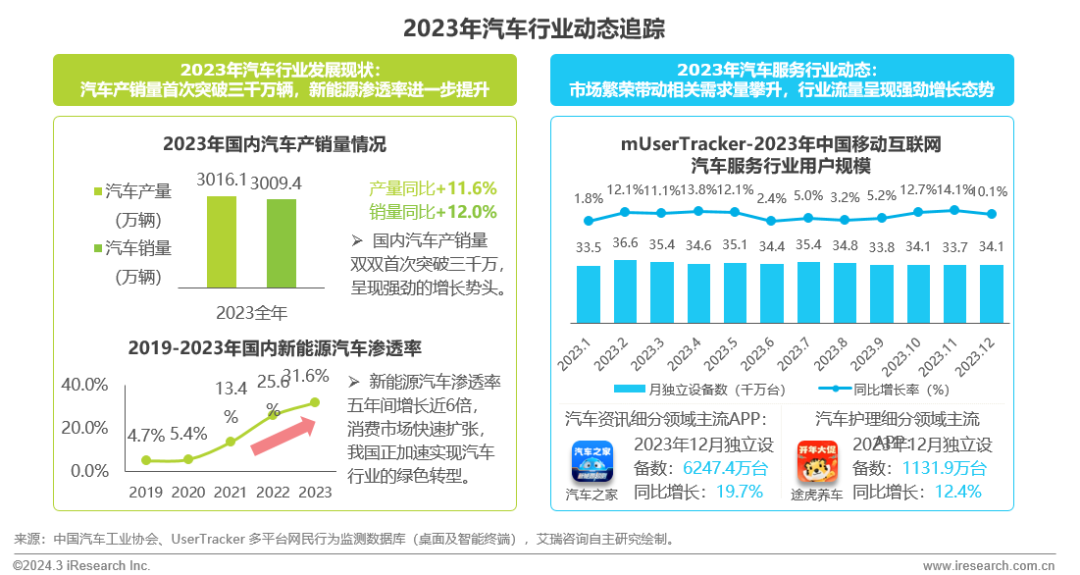

Automobile Services - Industry Overview in 2023

Domestic auto production and sales hit a record high, with new energy vehicles particularly outstanding, achieving a penetration rate of over 30%. The prosperity of auto consumption has stimulated the growth of related demands, and the traffic in the auto service industry has increased significantly.

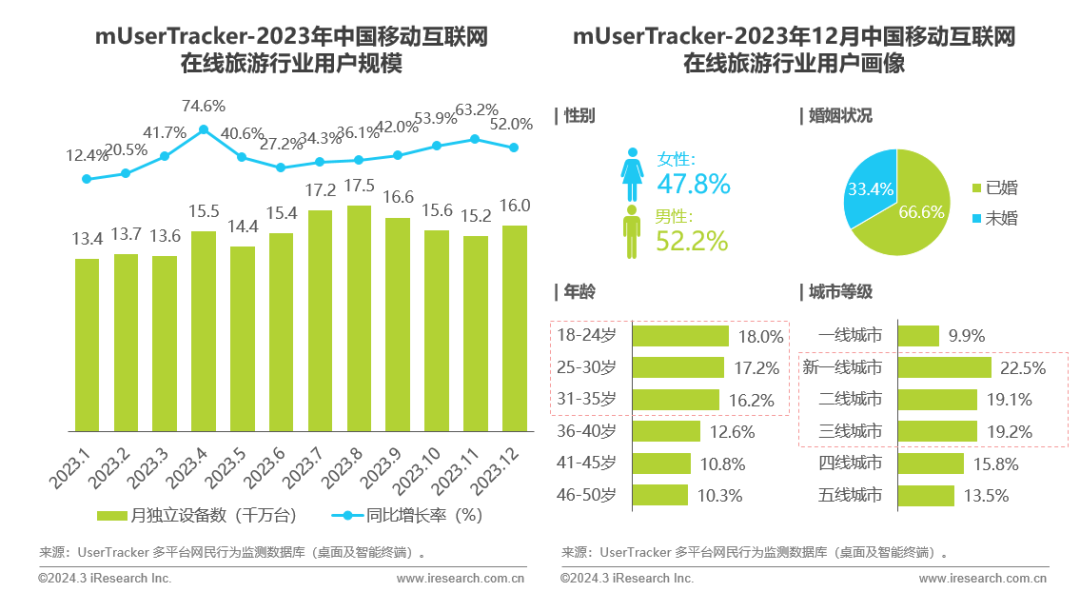

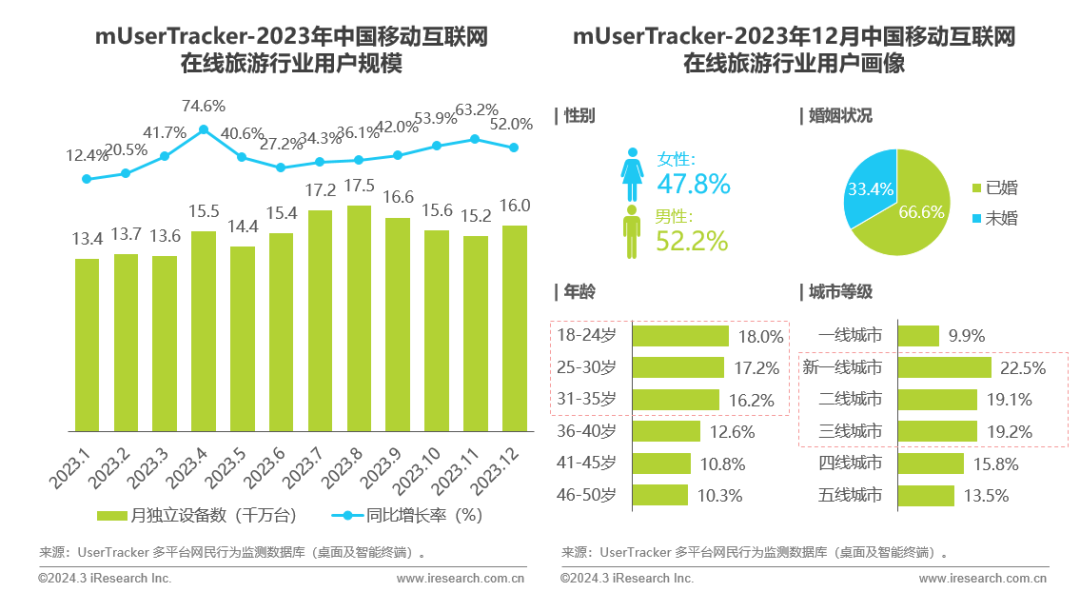

Online Tourism - Industry Overview and User Personas

The traffic experienced explosive growth throughout the year, with young users from mid-tier to high-tier cities being the main source of traffic, and users aged 18-24 accounting for the highest proportion.

—— Work & Study ——

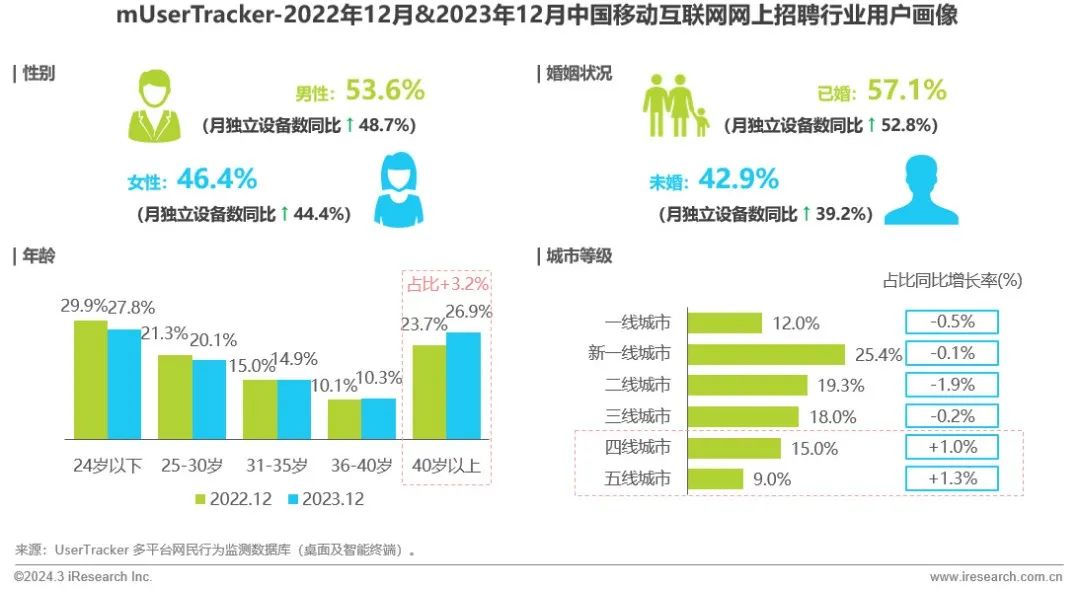

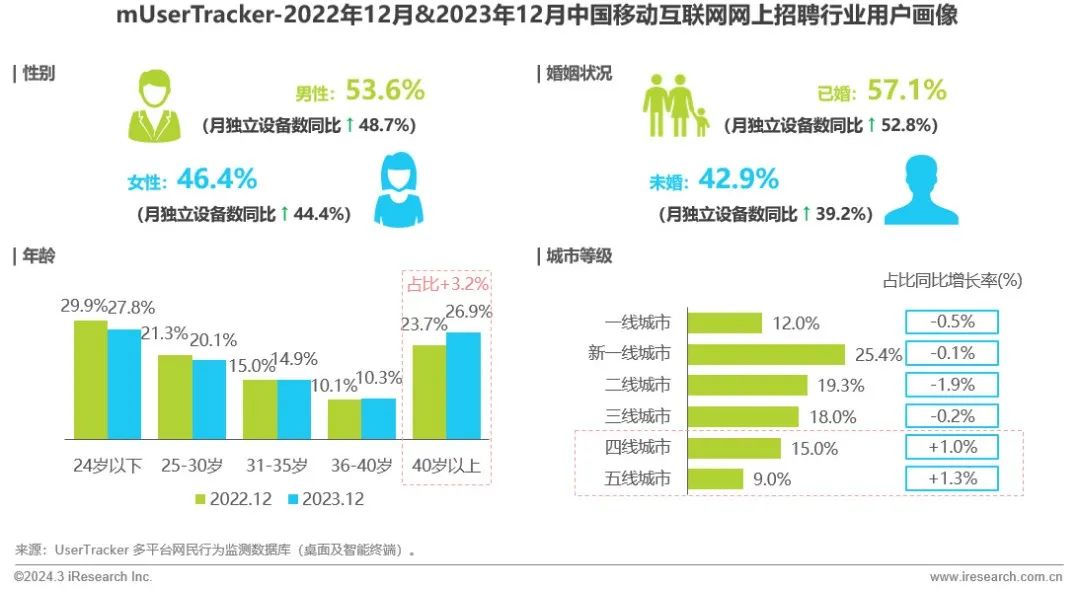

Online Recruitment - Industry Overview and User Personas

From January to December, traffic remained high, with the Top 3 Apps contributing nearly 80% of the total. The newly added active user group is concentrated among males, over 40 years old, married, and residing in fourth-tier cities and below.

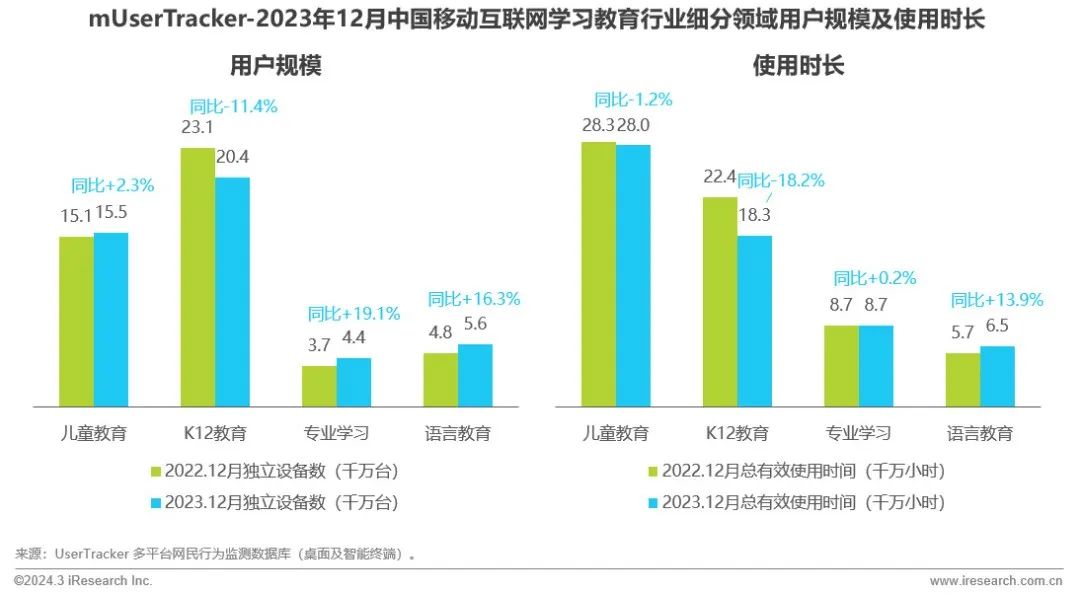

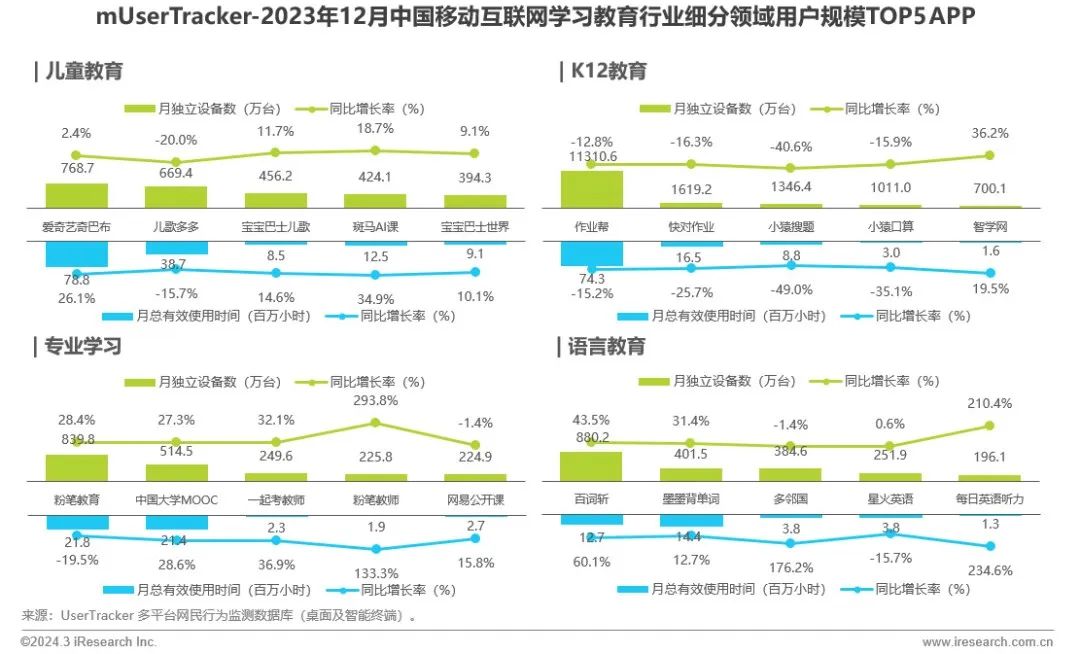

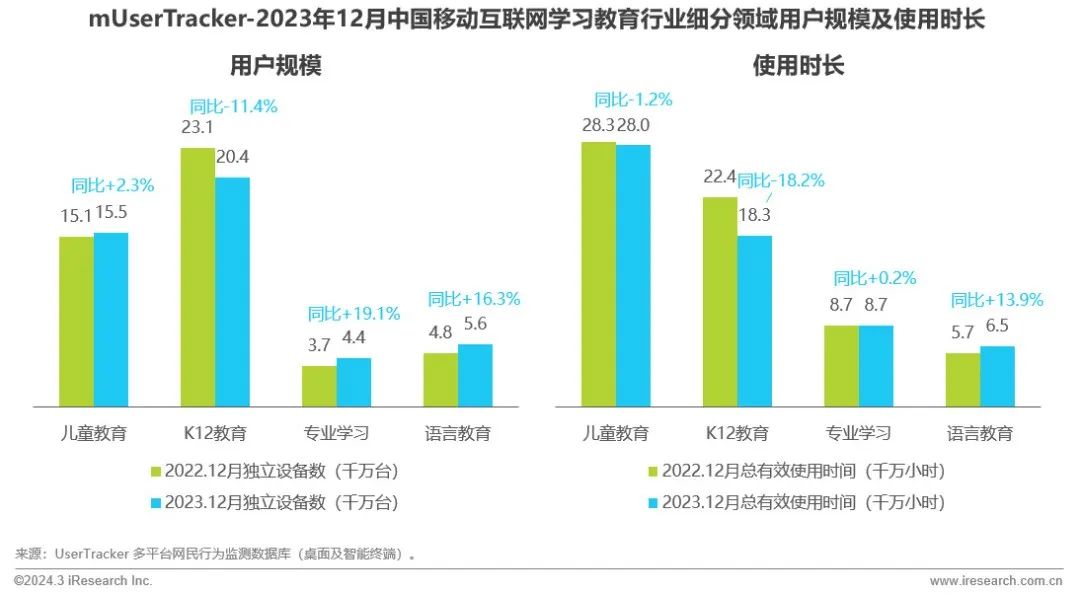

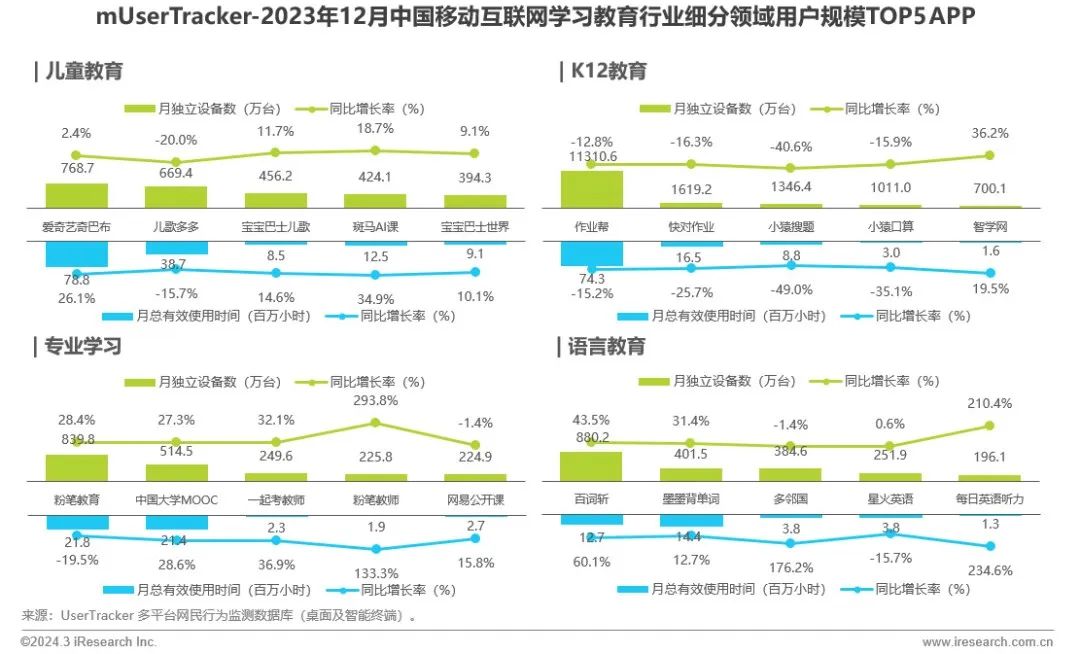

Learning and Education - Industry Overview and Overview of Mainstream Apps

Both the traffic and duration of professional learning and language education have increased in sub-industries. Leading Apps play a dominant role in these sub-sectors, guiding the trends of industry traffic and user behavior.

—— Pan-entertainment ——

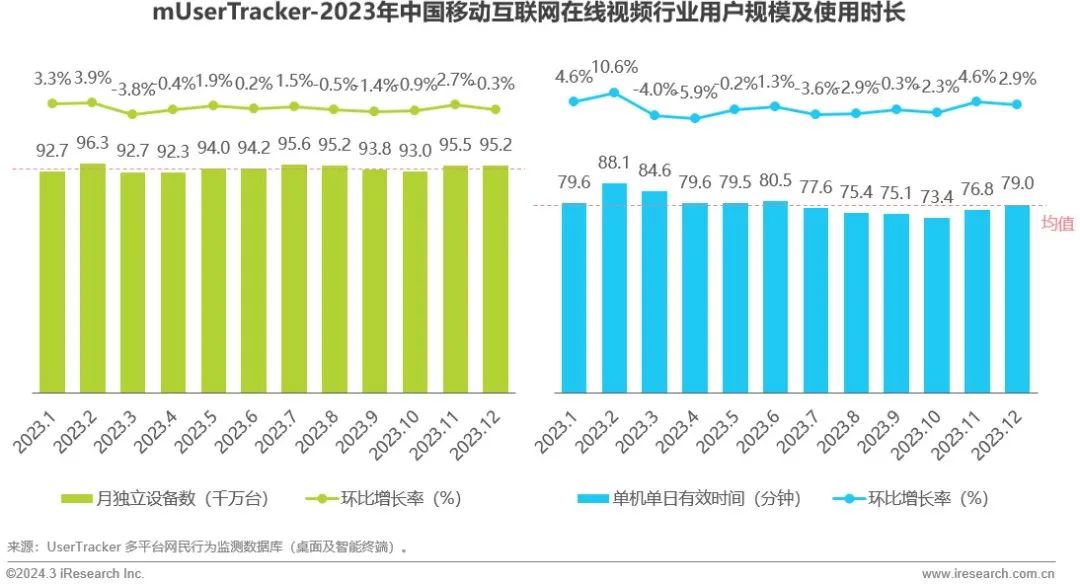

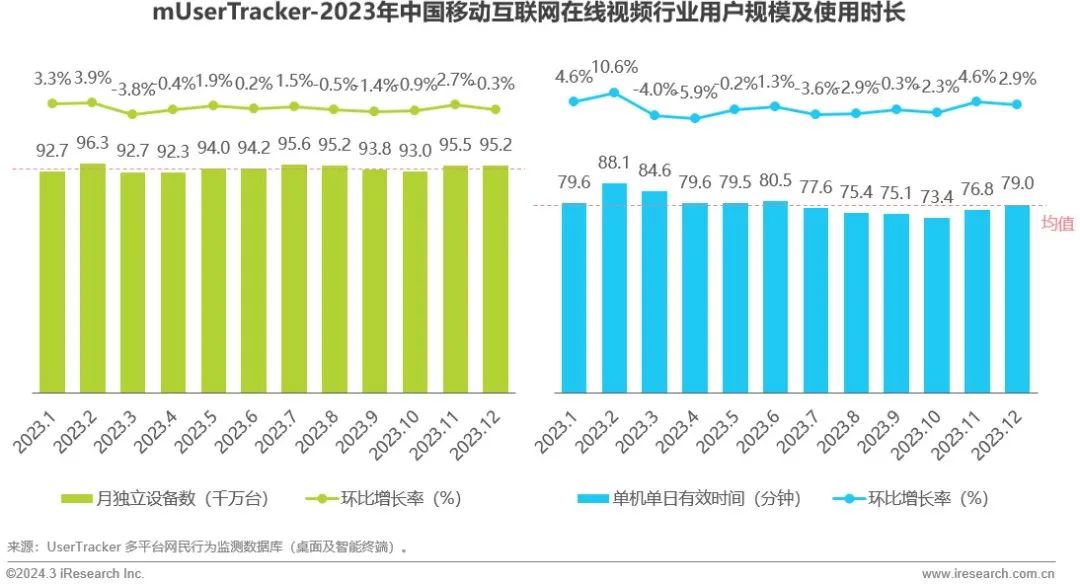

Online Video - Industry Trends and Overview in 2023

High-quality TV-series such as “The Knockout,” “The Long Season,” and “Blossoms Shanghai” have driven both platform traffic growth and improvements in reputation and revenue. Users aged 30 and below account for nearly 40% of the total, with the proportion of users from first-tier and new first-tier cities increasing. User habits have been consolidated, and traffic has remained stable throughout the year.

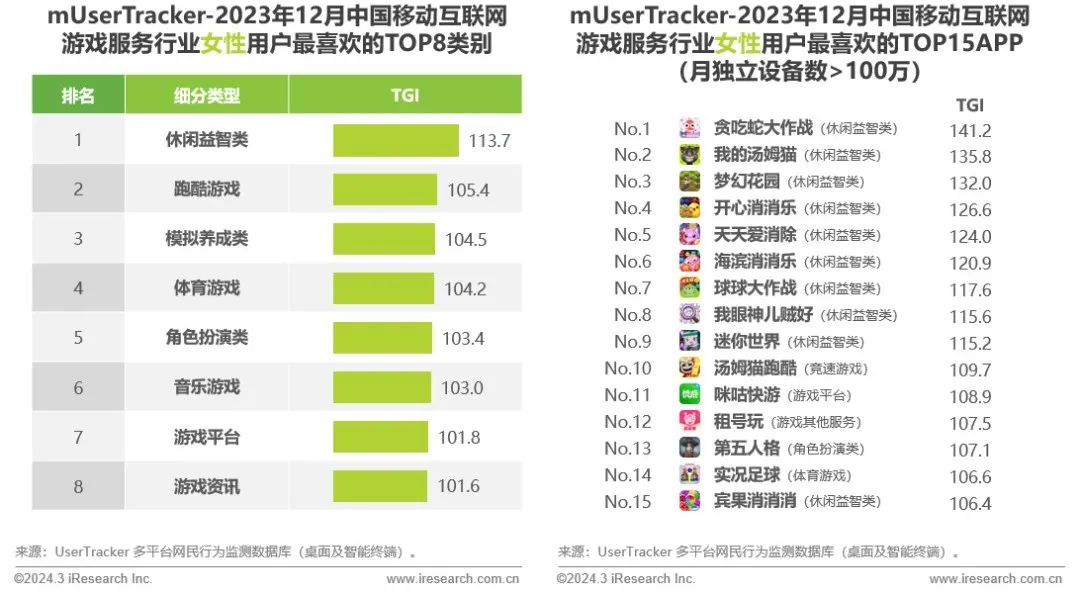

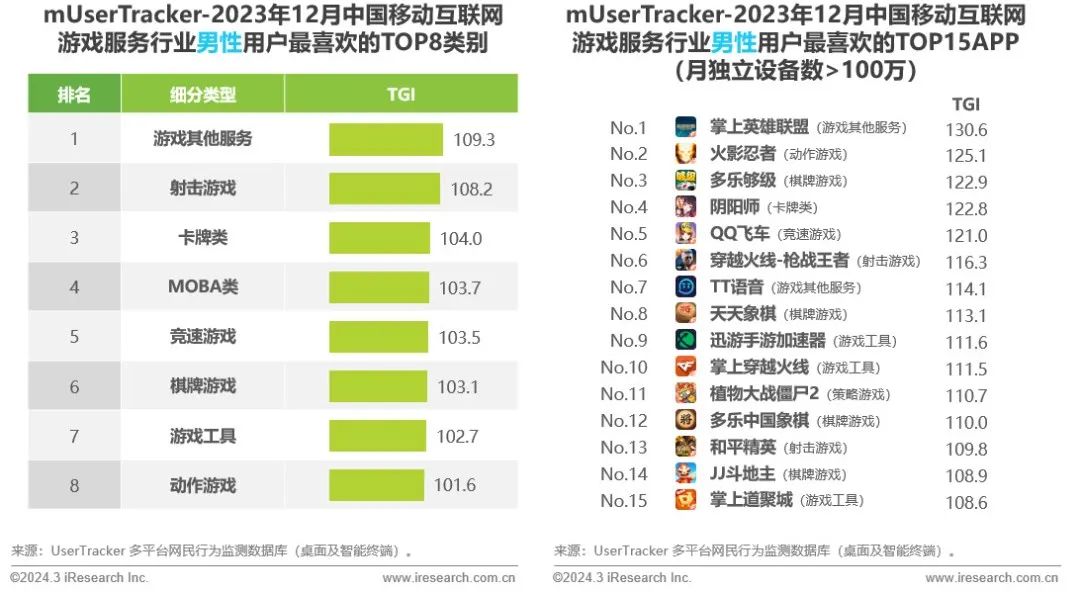

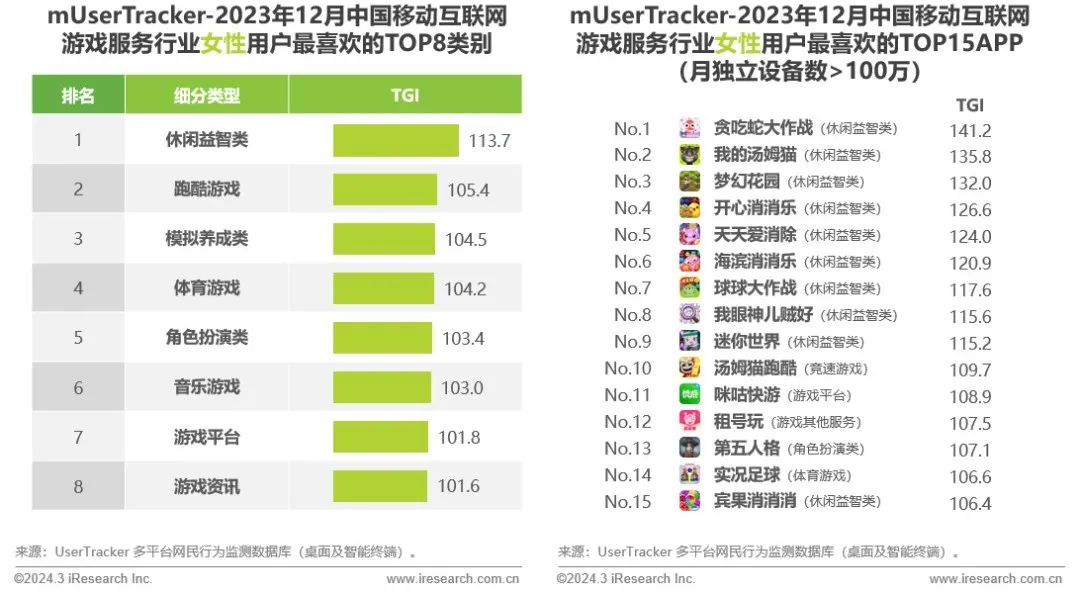

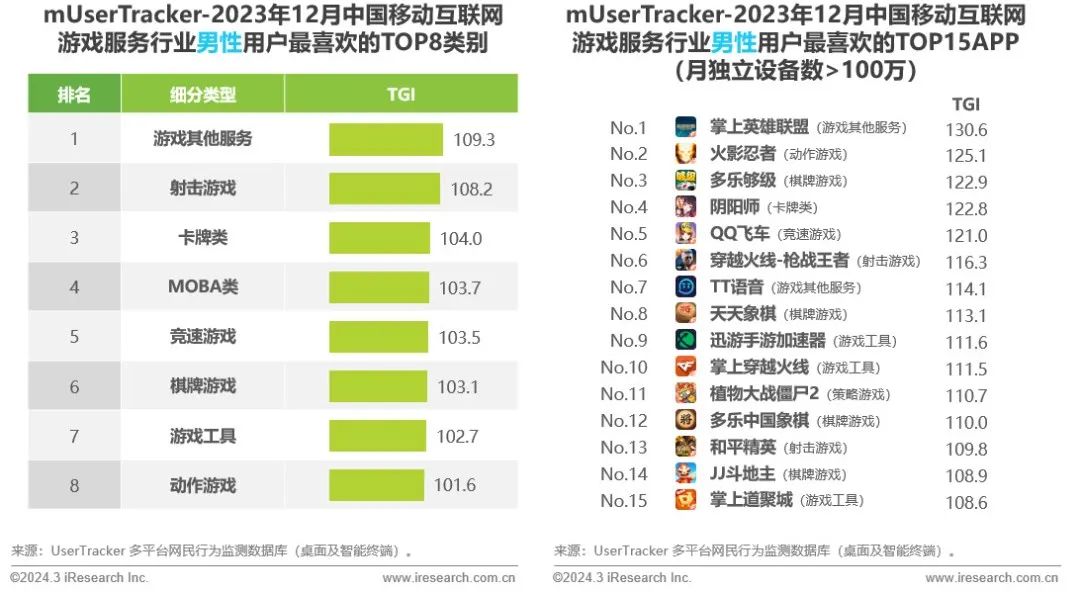

Game Services - User Preferences

Female users prefer puzzle games the most, while male users tend to favor shooter, card, MOBA, and racing games.

03

2023 China's Mobile Internet Value Ranking

2023 China's Mobile Internet User Growth Ranking

Top 10 Growth Ranking for Apps with Over 100 Million Users

Top 15 Growth Ranking for Apps with Over 50 Million Users

2023 China Mobile Internet User Preference Ranking

Top 10 Favorite Apps Among Users Aged 24 and Below

Top 10 Favorite Apps Among Users Aged 25-35

......